buy close vs sell close

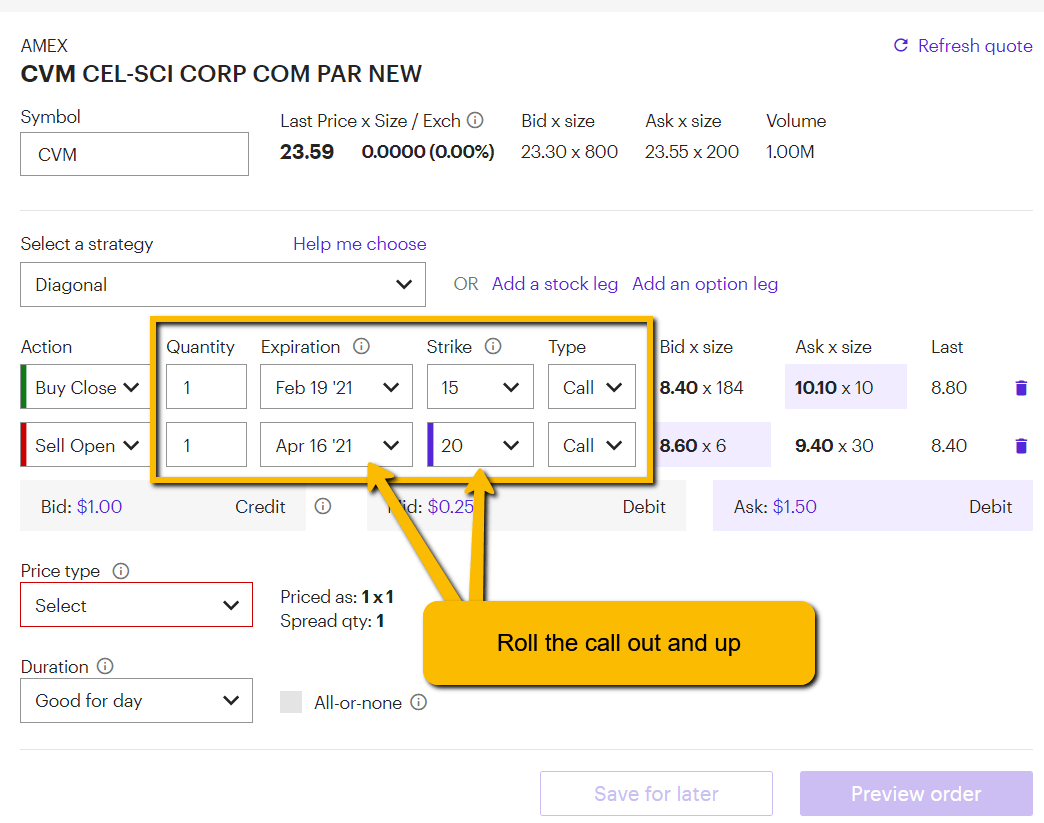

Mostly because it allows the investor to go along with either a call. Sell to open is STO.

Sell To Close By Optiontradingpedia Com

As discussed in the previous section the Sell To Open order is used to sell new write options contracts.

. These involve sell to close and buy to close. Sell to close is of course STC. For long positions you have sell to close and buy to open.

This is true and its. Buy to close is used when a trader is net short an option position. Simply put whenever a Sell To Open order is placed which involves the creation and sale of a call or put option a Buy To Close is required to close the position.

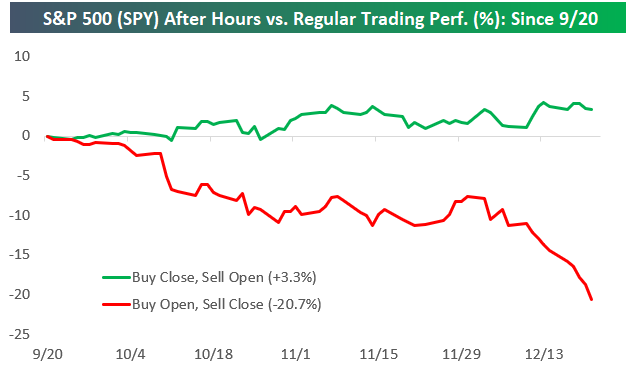

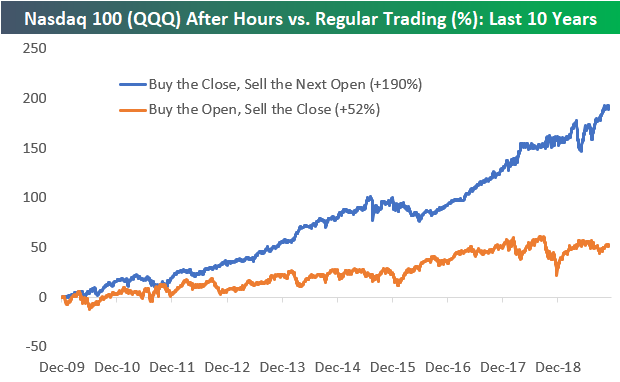

One can buy or sell a call or put. With call options the value. In a note Monday afternoon analysts at Bespoke Investment Group compared the performance of the buy the open sell the close strategy to buy the close sell the open.

Sell to close is often the most common choice for traders. Most trading platforms allow you to customize how the buttons show up in your order entry window. In short when you buy to close you end up with a better deal.

A trader can begin the options trade by either buying going long or selling going short. Closing short positions in options are. The expression Buy Close implies that a merchant is selling-finishing off either a put or call choice.

Sell To Close When an investor buys a sell to close order before closing with an option that was short on the option then the contract is closed and withdrawn from the public. To be able to sell to open you. All initiating short options trades are marked Sell to Open STO.

At the other extreme when you sell to close youre paying more for what you have. At the end of the day Buy open implies that you need to make open another option. Buy to close refers to terminology that traders primarily option traders use to exit an existing short position.

If the share price remains lower than. Sell to open refers to a trader selling a put or call option but remaining within the contract while sell to close refers to an original buyer of the option who sells either a call or. All closing long option trades are marked Sell to Close STC.

In comparison the Sell To Close order is used to sell an existing options contract that you already own and it is used for both call and put options. Sell To Open Vs Sell To Close. Sell to close is employed to close a long position originally established with a buy to open order and can be compared with buy to close and sell to open orders.

In other words you need a sell-to-open order to establish a new position with short calls and puts. When shorting the trader instructs their. Buy to close displays as BTC.

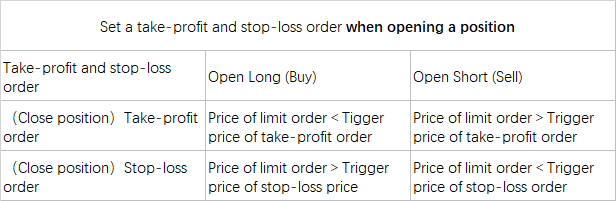

Take Profit And Stop Loss Operation Instruction Pomosh

Option Order Types Buy To Open Vs Sell To Open Youtube

/Term-Definitions_shortselling_FINAL-781cdf1e97ab4425939eb109b666a004.png)

Short Selling What Is Shorting Stocks With Pros Cons And Examples

Super Bowl Ads Fetch Record 6 5m Nbc Says In 18 Uptick Deadline

The Intraday Bear Market Bespoke Investment Group

Buy The Open Or Buy The Close The Chartist

Buy To Open Vs Buy To Close Options

Historical Buy Close Sell Open Vs Buy Open Sell Close Returns R Wallstreetbets

Zerohedge On Twitter Sell The Open Buy The Close Retire Https T Co 62mkyqokqr Twitter

Expert Introduction To Option Trading

A How To Guide On Selling Options So You Can Actually Do It Seeking Alpha

/95528215-5bfc2b71c9e77c002630606b.jpg)

How To Trade Options Buying Or Selling Call And Put Options

A Successful After Hours Trading Pattern Is Broken By Trump S Tweets Barron S

Buy To Open And Buy To Close Options Terminology Explained Youtube

Buy To Open Vs Buy To Close What It Means And How It Works In Real Life Money Masters

August 2021 Emeryville Real Estate Rental Report No Signs Of Market Slowdown Rents Approaching Pre Pandemic Levels The E Ville Eye Community News

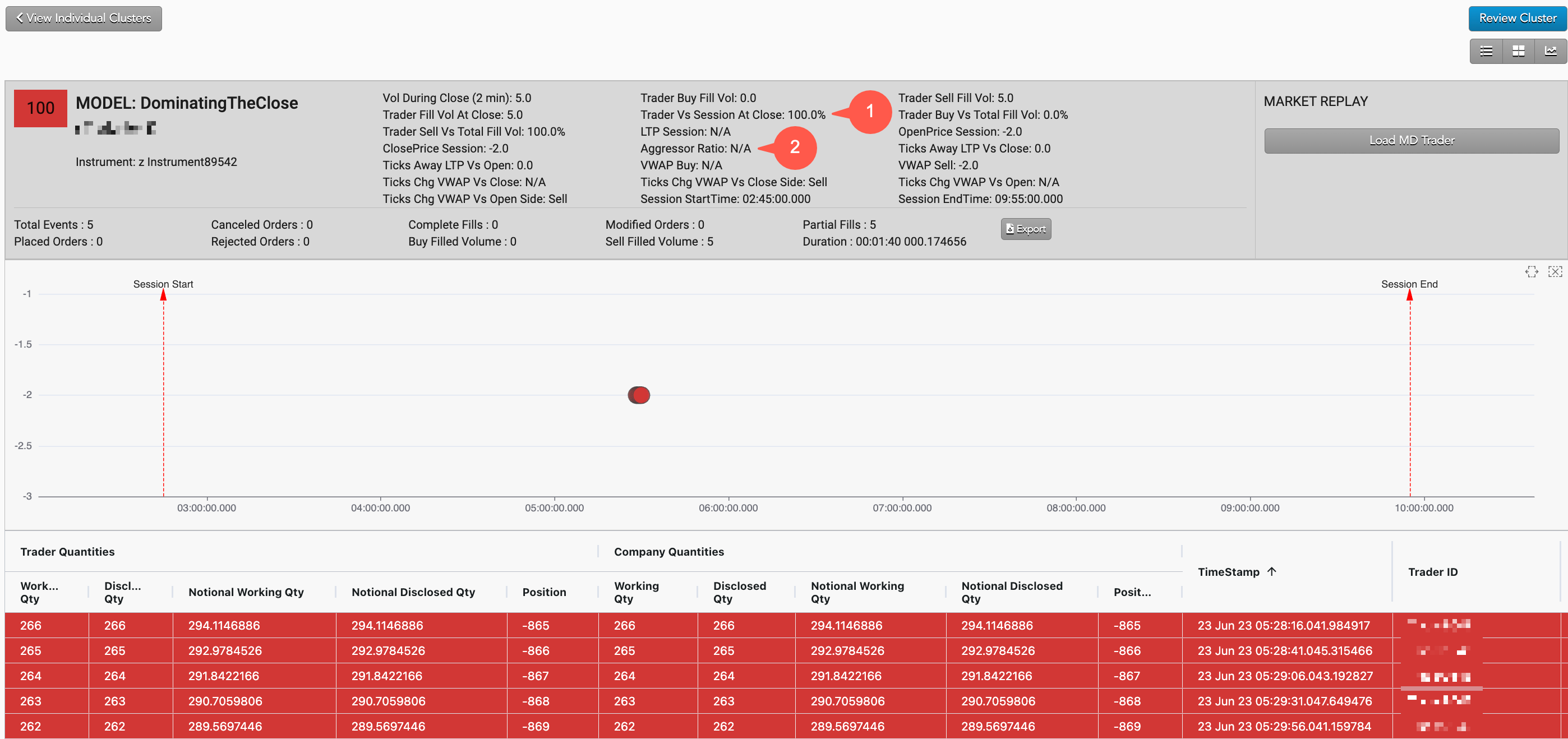

Dominance At Close Tt Score Help And Tutorials

Bespoke On Twitter Here S A Look At Only Owning Qqq After Hours Vs Regular Trading Hours Over The Last 10 Years Buying At The Close And Selling At The Next Open Has

After Hours Vs Regular Trading Hours Bespoke Investment Group